Whoa! Ever stumble upon something in crypto that just clicks? That’s how I felt diving into the world of Solana wallets and SPL tokens recently. At first, I thought, “Okay, it’s just another blockchain hype.” But the more I poked around, the more it felt like Solana’s ecosystem is quietly reshaping DeFi in ways that are both slick and practical.

Here’s the thing: if you’ve been around crypto for a minute, you know wallets aren’t just about holding tokens anymore. They’re the gateway to entire ecosystems where staking, yield farming, and token swaps happen seamlessly. But not all wallets pull this off well, especially when you want to juggle SPL tokens — those native Solana tokens that are essential for interacting with projects on the network.

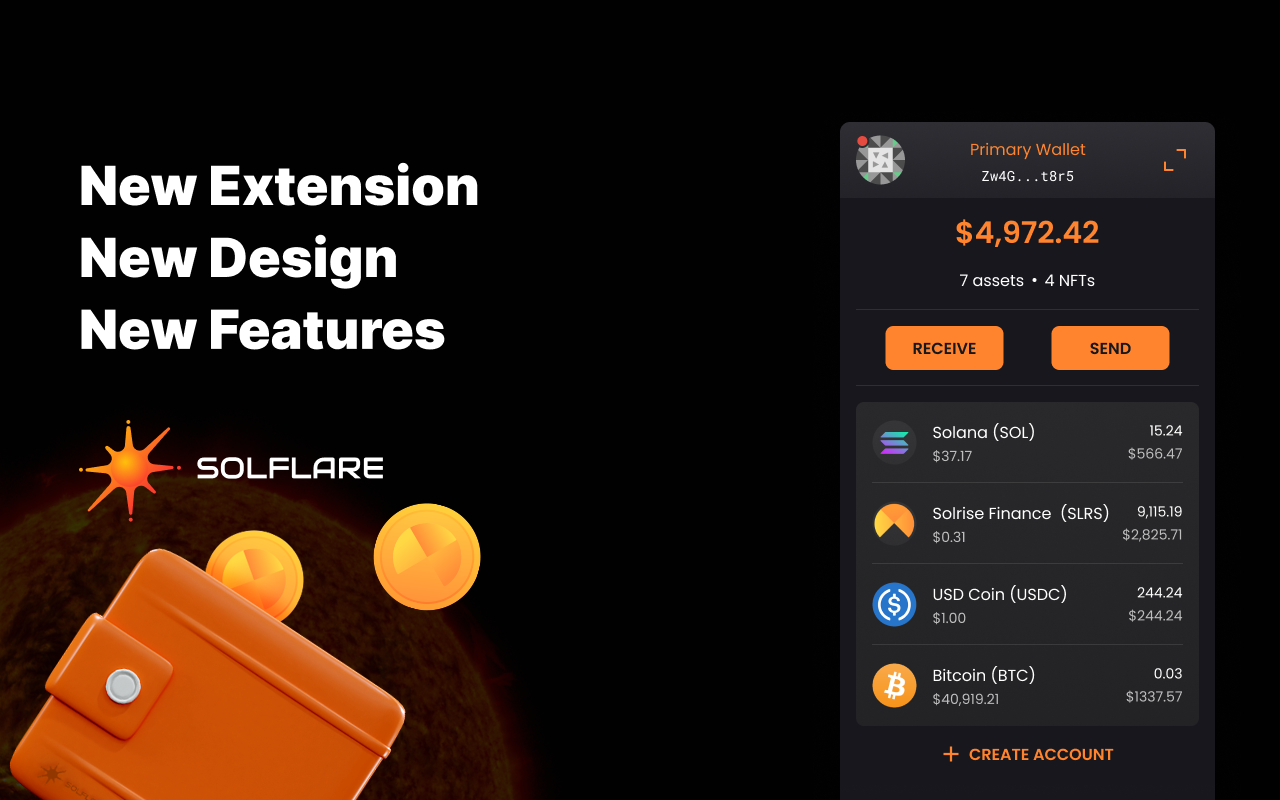

Initially, I was skeptical about whether a wallet could really simplify the complexity of managing SPL tokens while offering intuitive yield farming options. Actually, wait—let me rephrase that. I was skeptical about whether a wallet could be both secure and user-friendly without drowning you in confusing interfaces. Turns out, that’s exactly where solflare steps in.

So, what makes Solana wallets like Solflare different? For starters, the blazing transaction speeds. Seriously, the network confirms transactions in less than a second, which is a breath of fresh air compared to those painfully slow Ethereum gas wars. That speed really matters when you’re farming yields, where every second can impact your returns.

But speed isn’t everything. The integration with SPL tokens means you can hold, stake, and swap these tokens directly within the wallet, without hopping between dApps or third-party services. This tight integration feels like someone finally got what users actually want — smooth, fast, and secure access to their assets. Something felt off about older wallets that forced me to juggle multiple tabs and extensions just to stake or swap tokens.

Okay, so check this out — managing SPL tokens within Solflare isn’t just about convenience; it’s about trust. The wallet uses non-custodial technology, so you control your private keys. That’s huge because, in the US especially, folks are wary of handing over control to centralized exchanges or wallet providers. I’m biased, but having that peace of mind while diving into yield farming makes the whole experience less nerve-wracking.

Yield farming itself on Solana? It’s a different beast. On one hand, the APRs can be very very tempting. On the other, volatility and impermanent loss linger as ever-present risks. My instinct said to tread carefully, but the ecosystem’s rapid growth made me curious enough to experiment. I dipped a toe in several farms, using Solflare to stake my SPL tokens. The interface made it easy to track my earnings and compound returns, which—let me tell you—is a game-changer compared to clunky dashboards I’ve used before.

However, it’s not all sunshine. Here’s what bugs me about the current landscape: the fragmentation of yield farming protocols means you need to stay vigilant about scams and rug pulls. Even with a trusted wallet, if you blindly throw tokens into a shady farm, you’re asking for trouble. That’s why I always recommend pairing your wallet choice with strong research habits.

By the way, if you’re wondering how to get started with this whole thing, Solflare offers a browser extension that’s simple to install and interacts directly with the Solana blockchain. It’s a neat package—no unnecessary fluff, just straightforward tools for managing SPL tokens and participating in DeFi. Honestly, for someone who’s jumped through hoops with other wallets, this felt like a breath of fresh air.

Something else to consider: as DeFi matures on Solana, the wallet’s role will only grow. I’m not 100% sure how governance tokens and cross-chain bridges will shake things up, but having a robust wallet that supports SPL tokens is foundational. It’s like having a Swiss Army knife in your back pocket when you’re navigating this wild west of finance.

Now, I can almost hear some folks saying, “But what about security? What if Solana hits a snag?” True, no tech is bulletproof. However, Solflare’s continuous updates and community feedback loop have made it pretty reliable so far. Plus, because it’s non-custodial, even network issues don’t compromise your keys — a subtle but crucial distinction.

Really, the more I dig into yield farming with SPL tokens on Solana, the more I appreciate how wallet design shapes user experience. The technical stuff matters, but how those technicalities translate into real-world usability? That’s what separates the winners from the also-rans. So, if you’re on the hunt for a solid Solana wallet, definitely give solflare a look.

Navigating the Risks and Rewards of Yield Farming on Solana

Yield farming sounds amazing in theory — passive income while you sleep, right? But here’s the kicker: it’s not a set-it-and-forget-it deal. I’ve learned that the yields can be very very attractive, but the underlying protocols are still evolving fast. Some farms offer triple-digit APRs, but they come with high risks, like token price crashes or sudden liquidity withdrawals from other participants. It’s honestly a bit like riding a roller coaster without knowing when the brakes will hit.

On one hand, the Solana network’s speed and low fees reduce some friction. On the other, the DeFi landscape is fragmented, and new farms pop up daily. I got caught once by a farm that looked legit but had poor audit coverage. That experience made me double down on using wallets that give me clear visibility into my SPL tokens and transaction histories. Solflare has been helpful here, with its clean UX and detailed token info.

Another wrinkle: yield farming strategies often require you to stake multiple SPL tokens, sometimes across several protocols. Keeping track without a solid wallet is a headache. I found myself juggling multiple spreadsheets before switching to a wallet that consolidates most of this info. Plus, the ability to quickly unstake or swap tokens without leaving the wallet saved me from a couple of potential losses when market swings came suddenly.

Let me be clear: I’m not saying yield farming is for everyone. But if you’re curious and willing to learn, having the right tools makes a huge difference. The ecosystem’s still young, which means you can catch early opportunities—but also get burned if you’re careless. Patience and caution go hand in hand here.

Oh, and by the way, staking SPL tokens in Solflare comes with a nice bonus: the wallet sometimes integrates airdrops and governance voting features, so you’re not just farming yields, but also engaging with the community. That kind of participation was missing from my early crypto days, and it adds a layer of connection that’s pretty cool.

So yeah, it’s a wild ride. But having a wallet that keeps you connected, informed, and in control of your SPL tokens? That’s half the battle won. Honestly, I wish I’d found solflare sooner—it’s made diving into the Solana DeFi jungle way less daunting.

Frequently Asked Questions

What are SPL tokens, and how do they differ from other tokens?

SPL tokens are Solana’s equivalent of Ethereum’s ERC-20 tokens. They’re native to the Solana blockchain and are used for various purposes like DeFi, staking, and governance. Managing them requires wallets that specifically support Solana’s architecture, unlike generic wallets that focus on Ethereum or Bitcoin.

Is Solflare safe for storing and staking my tokens?

Solflare is a non-custodial wallet, meaning you control your private keys, which significantly reduces custodial risks. It’s open-source and has a strong community backing. While no wallet is 100% foolproof, Solflare’s security practices and continuous updates make it a solid choice for Solana users.

Can I do yield farming directly through Solflare?

Yes, Solflare integrates with many DeFi protocols on Solana, allowing users to stake SPL tokens and participate in yield farming without leaving the wallet. This integration simplifies the process and helps track your farming rewards more easily.